Flood Insurance in Maine

Allen/Freeman/McDonnell Agency

Flood Insurance

- What Is It?

- Who Needs It?

- Coverages Offered

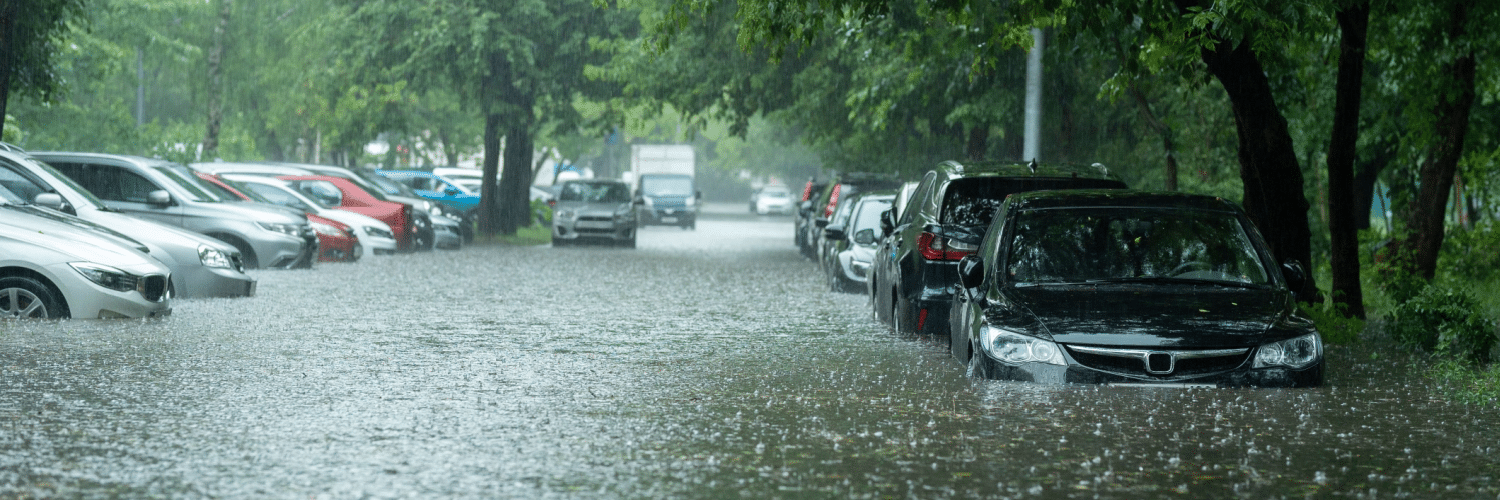

Flood insurance normally provides coverage during intense storm conditions, when water levels rise and could cause damage. Without flood coverage, properties could be unprotected during such storms. Other abnormal water events may be covered, too.

Flood coverage is much less often purchased for properties in low-risk or unknown-risk zones. Policies may be so inexpensive for low-risk zones, though, that they might be worth considering.

- Building Coverage

- Personal Property Coverage:

- Basement Contents Coverage

What is flood insurance?

Floods present a significant threat that’s typically not covered under most standard homeowners insurance policies. For property owners in Maine looking to safeguard their homes or businesses against this risk, flood insurance can be a crucial coverage.

Flood insurance normally provides coverage during intense storm conditions, when water levels rise and could cause damage. Without flood coverage, properties could be unprotected during such storms. Other abnormal water events may be covered, too.

Who in Maine should consider flood coverage?

Maine property owners generally need flood coverage if their property is in a FEMA designated high-risk flood zone. Federal law usually requires coverage in this case.

Moreover, properties don’t necessarily have to be near large bodies of water to be located in a high-risk zone. Ponds, streams and books can swell so they cause property damage. Any property that’s near water, regardless of how small the water is, should be checked to see if it’s in a high-risk zone.

Flood coverage is much less often purchased for properties in low-risk or unknown-risk zones. Policies may be so inexpensive for low-risk zones, though, that they might be worth considering.

An experienced insurance agent who knows flood policies well can help property owners check whether their home or other property is in a high-risk zone.

Request A Quote!

What types of properties can flood policies cover?

Flood policies are available for a wide variety of properties. These may include single-family homes, townhouses, condominiums, multi-unit rental properties, commercial buildings, mixed-use developments, and more. Renters can also find policies that offer flood protection.

What risks are covered under flood policies?

Flood policies typically cover various risks arising from natural, but uncommon, water-related events that cause property damage. Depending on a policy’s specific terms and conditions, coverage might include:

- Floods (resulting from rising water levels)

- Unusual wave events (especially along coastal areas)

- Mudslides and mudflows (under specific circumstances)

- Other risks (as defined by the policy)

What coverages are available within flood policies?

Flood policies may offer several distinct coverages. Policies under the National Flood Insurance Program (NFIP) generally provide coverages mandated by the federal program, while private market policies can offer additional protections. Some typical coverages include:

- Building Coverage: Might cover the main building on a property, including attached improvements, such as fences.

- Personal Property Coverage: Might cover personal items at the property, such as furniture, electronics, clothing, appliances, etc. Unlike some homeowners policies, coverage is usually limited to belongings that are physically located at the property, and items stored in a crawl space or basement could be excluded.

- Basement Contents Coverage: Might cover personal items stored in a crawl space basement. This is usually only necessary if items in a these spaces are excluded under personal property coverage.

- Pool Repair and Refill Coverage: Might cover an above-ground or in-ground pool, including surrounding features. This may be an option under building and/or personal property coverage.

- Unattached Structures Coverage: Might cover secondary structures, which can include gazebos, boathouses, retaining walls, and similar structures if they’re near water.

- Temporary Living Expense Coverage: Might cover costs such as lodging and meals when a property is uninhabitable due to a covered flood event.

Should property owners purchase a flood policy through the NFIP or the private marketplace?

The National Flood Insurance Program is a federally funded initiative that subsidizes flood coverage for properties in high-risk areas as per FEMA maps.

To qualify for NFIP coverage, a property usually must be in a high-risk area, and the community must participate in the program (most do). This is often the most affordable way to get flood coverage for eligible properties.

However, being outside a high-risk area does not mean immunity from potential flood or mudslide risks. In such cases, coverage can usually be obtained through the private insurance market. Premiums are frequently affordable for properties in lower-risk areas.

Property owners in high-risk zones seeking additional protection might also consider a private market policy. For instance, owners of large waterfront buildings might need higher coverage limits than what’s available through the NFIP.

How can property owners in Maine get flood insurance?

For help finding flood insurance for a property in Maine, reach out to the independent insurance agents of Allen Freeman McDonnell Agency. We’ll work closely with you to assess your property’s risk exposure, and find a policy that’ll protect your property well.